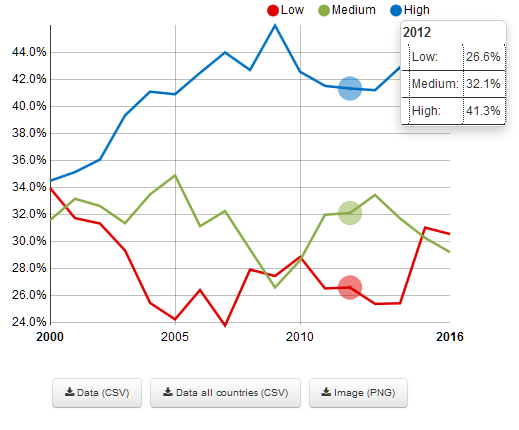

By what mechanisms can a tax increase lead to a decline in activity? In this CEPII Working Paper, François Geerolf & Thomas Grjebine first observe a very negative effect on consumption (-3.5% after 3 years). Part of this decline is undoubtedly due to the direct decline in agents' disposable income. But the measured decline far exceeds the single tax increase on homeowners, since consumption accounts for about 60% of GDP (the direct effect would therefore be at most 1% / 0.6 = 1.7%). This suggests the multiplier effects, such as an initial drop in consumption leads to a fall of aggregate demand, which in turn impacts consumption through a decline in demand for labor, leading to more unemployment. The effect on non-residential investment is also very important, with a decline of nearly 11% after 3 years. If a rise in the property tax leads to a fall in consumption and investment, it also reduces imports almost immediately (-10.6% after 3 quarters). Property tax changes finally have a significant effect on real estate prices. According to our estimates, a tax increase of 1% of GDP leads to a fall in property prices (adjusted for inflation) by 17% after 3 years. >>> |

- Property Tax Shocks and Macroeconomics

François Geerolf, Thomas Grjebine - The tale of two international phenomena: International migration and global imbalances

Dramane Coulibaly, Blaise Gnimassoun, Valérie Mignon

- Energy Policy

On the current account - biofuels link in emerging and developing countries: do oil price fluctuations matter?

Gabriel Gomes, Emmanuel Hache, Valérie Mignon, Anthony Paris

Country focus: China

The prospects for the Chinese economy after the constitutional reform

March 21, 2018

CEPII-PSE Paris Migration Seminar

April 10, 2018

CEPII 40th Anniversary Conference : France and Europe in Globalization

April 12, 2018

CEPII-CAE conference: Stabilizing the Euro area. Political and economic perspectives

May 15, 2018

“Israel and the World Economy – The Power of Globalization”

with Professor Assaf Razin, Tel Aviv University

May 17, 2018

18th Doctoral Meetings in International Trade and International Finance

June 15 - 16, 2018

CEPII 40th Anniversary Conference : France and Europe in Globalization Ten years after the crisis, the international economic relationships are being deeply transformed in many areas such as the economic and financial stability, international competitiveness, migration flows and the climate change challenge. What are major challenges that France and Europe are facing in today’s context? To address this question, the CEPII organizes, on the occasion of its 40th anniversary, three panel discussions, each bringing together three experts, foreign and French, decision-makers and academics. Programme >>> |

Country Profiles The CEPII Country Profiles offer a unique synthesis of information on the international integration of 80 economies. The proposed indicators, based on CEPII's original databases, make it possible to characterise changes in market shares or the structure of exports since 1967 as well as to analyse the ranges of products exported or trade protection in international comparison. These data, provided in the form of easily downloadable tables and graphs, are intended for information, expertise and teaching. The update of the data with the addition of data for 2016 is now available. >>> |

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli