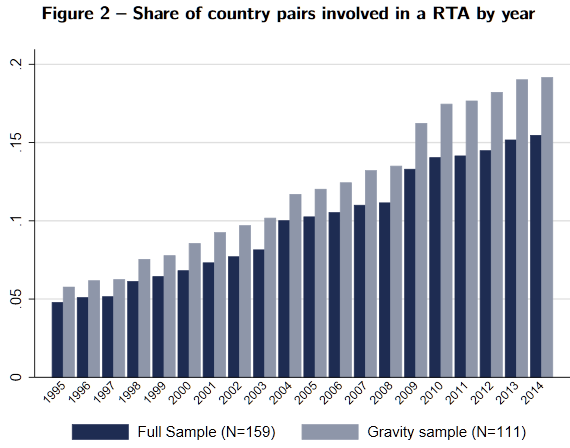

There has been considerable attention paid to the endogenous nature of regional trade agreements Geography, economic size, or common history help predicting signed agreements. However, not all signed RTAs are “natural" according to economic determinants, as trade negotiations can be used as a tool of external policy. Recent developments in terms of structural gravity help clarifying this debate by taking account of all theoretically relevant determinants of bilateral trade, as well as general equilibrium effects of signing an agreement. Indeed, the endogeneity of trade arrangements has a time dimension and is related to firm strategies. These are the two mechanisms addressed in this paper. We estimate the time-varying probability for a country pair to sign a trade agreement and build upon structural gravity in general equilibrium to determine how the patterns of Global Value Chains shape the evolving geography of optimal trade agreements. Our results confirm that the endogenous geography of RTAs is shaped by the development of GVCs. Lionel Fontagné & Gianluca Santoni >>> |

- The Effects of Immigration in Developed Countries: Insights from Recent Economic Research

Anthony Edo, Lionel Ragot, Hillel Rapoport, Sulin Sardoschau & Andreas Steinmayr

- Trade and currency weapons

Agnès Bénassy-Quéré, Matthieu Bussière, Pauline Wibaux - Do Unit Labor Costs Matter? A Decomposition Exercise on European Data

Sophie Piton - The Cost of Non-Europe, Revisited

Thierry Mayer, Vincent Vicard, Soledad Zignago - GVCs and the Endogenous Geography of RTAs

Lionel Fontagné, Gianluca Santoni

18th Doctoral Meetings in International Trade and International Finance

June 15 - 16, 2018

Research seminar "No double standards: quantifying the impact of standard harmonization on trade"

June 19, 2018

The World Trade Report 2018 "The future of world trade: how digital technologies are transforming global commerce"

by Cosimo Beverelli, Senior Economist, WTO

June 21, 2018

"Trump, Trade and the Dollar"

with Barry Eichengreen, Professor of economics and political science, Berkeley, University of California

June 22, 2018

CEPII conference "Real Equilibrium Exchange Rates: Relevance in Open Economy Macroeconomics and Operationality in Economic Policy-Making"

June 29, 2018

Workshop CEPII – EUR OSE-PSE:

What can economists say about trade wars?

July 4 - 5, 2018

L'économie mondiale 2019 - conférence de présentation

September 12, 2018

XVI ELSNIT Annual Conference : Technology and Trade

October 25 - 26, 2018

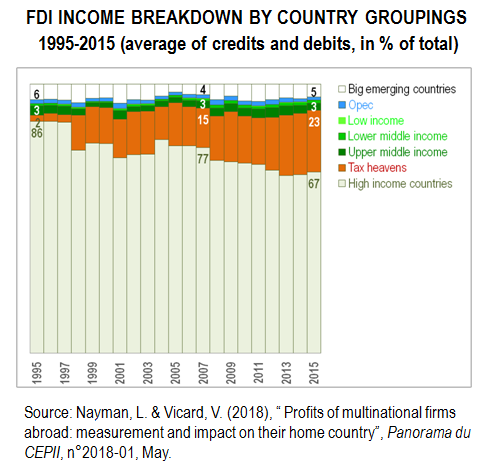

Profits of multinational firms abroad: measurement and impact on their home country

In this panorama Laurence Nayman & Vincent Vicard measure the national income linked to the activity abroad of multinational enterprises, recorded in the foreign direct investment (FDI) income item of the balance of payments. Their share in world flows doubled between 1995 and 2015. They contribute positively to the current account balance of high-income countries, but negatively to that of the rest of the world. As a result, they add to the gross national income of high-income countries. The predominant role of tax havens in FDI income flows underlines the significance of tax issues in the analysis of multinationals activity.

>>> |

CEPII is a member of the European Network for Economic and Fiscal Policy Research, a unique collaboration between policy-oriented university and non-university research institutes that are contributing their scientific expertise to the debate over the EU’s future design.

Read the June issue of the EconPol Europe Newletter.

Read the June issue of the EconPol Europe Newletter.

- Contact us

- Our other sites

|

ISSN: 1255-7072

Editorial Director : Antoine BouëtManaging Editor : Dominique Pianelli