Is China finally inhaling the smoke of international financial markets?

The recycling of current account and/or financial account surpluses through the accumulation of foreign exchange reserves by emerging countries after the 1999-2001 crisis, particularly by China, has been described as “smoking but not inhaling in international financial markets”.

By Christophe Destais

The last set of data published by the Bank for International Settlements (BIS) together with IMF statistics on China’s balance of payment might lead to think that things are changing.

The BIS report underlines the very steep increase of China’s foreign debt. In one and a half year, from the end of 2012 to June 2014, the loans from BIS reporting banks to Chinese banks have more than doubled to reach 1100 billion dollars and Chinese entities issued more than 360 billion dollars on the international capital markets.

This development of the international financing of China has immediate causes. A progressive relaxation of capital controls of capital inflows and outflows is underway. Banks and companies are probably using the new opportunities to tap cheaper financing than the one they can get from domestic sources whose credit activity remains somewhat under control. In addition, the big Chinese banks have quickly developed their international activities, in particular, their presence in the developed countries and the financing which they grant to emerging and developing countries.

Though still blurry, the picture that emerges from these data is different from the one of the previous decade, when China did not ‘inhale’ short term volatile capital flows.

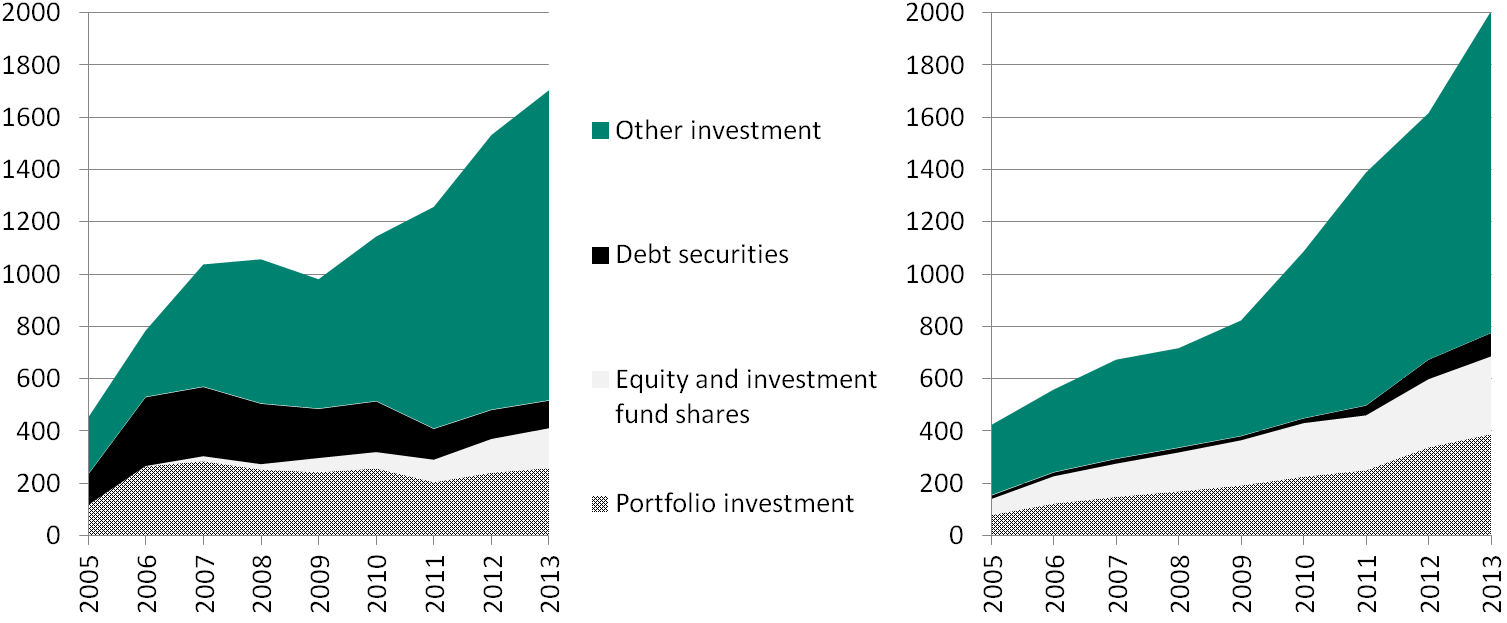

Figure 1 below illustrates the rise of foreign assets and liabilities of China excluding FDI and foreign exchange reserves since 2009 according to the statistics of the balance of payments of the IMF. The growth in nominal terms has been spectacular. The liabilities rose from 0.8 to 2 trillion dollars whereas the assets increased from 1 to 1.7 trillion dollars.

BIS data cover different concepts. They exclusively list the claims and the debts of the banks of the member countries of the BIS which communicate to the latter their banking statistics (the so called “reporting banks” of “reporting countries”). Though a member of the BIS, China is not a reporting country.

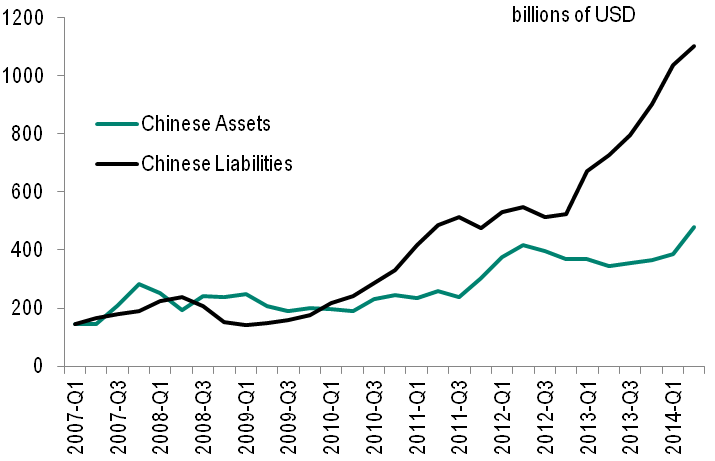

They show (see Figure 2 below) an even more spectacular dynamic of the insertion of China in the international financial channels. In addition, the gap between assets and liabilities is even more pronounced than in the IMF balance of payments statistics. Chinese liabilities towards reporting countries rose more than 7 times, from 0.15 trillion dollars in the middle 2009 to 1.1 trillion dollars in the middle of 2014. During the same period, the claims of China on BIS reporting countries’ banks more than doubled.

The difference between the claims of China towards the rest of the world, computed by the IMF, and those towards developed countries computed by the BIS might lead to think that the Chinese banks recycle part of the resources they source in OECD countries to developing countries who do not declare their financial statistics to the BIS.

With their currency depreciating vis-à-vis the US dollar and reduced commodity prices, these countries are becoming more vulnerable.

What remains unknown is the share of Chinese banks’ external assets and liabilities that are denominated in RMB on whom they would have no foreign exchange risk and which could be re-financed by the Chinese central bank, the PBC, if necessary. It is likely that this share is still trivial but we better understand one of the issues at stake when it comes to the internationalization of the Chinese currency. In other words, China would rather inhale the smoke of its home made tobacco than that of international providers, namely US produced greenbacks.

For their part, the Chinese foreign exchange reserves should see their value stabilizing or even falling because of the mechanical effects of the interest rates in the United States (not to mention RMB/USD exchange rate) whereas trade surplus decreases and the slowing down of growth and domestic policies make the country less attractive for foreign investors.

The current level of the reserves assets (3.9 trillion dollars or so) shields China from an international payments crisis, still for a very long time. Even though this level is so high that a massive mobilization of these reserves would have worldwide systemic consequences, it is likely that the Chinese government would come to the rescue of its main banks should the latter be weakened by defaults on their foreign currencies loans to emerging and developing countries. Nevertheless, this implicit or, in the case of export credit, explicit guarantee will not shield international lenders from isolated defaults from Chinese counterparties that are not guaranteed by the Government.

The BIS report underlines the very steep increase of China’s foreign debt. In one and a half year, from the end of 2012 to June 2014, the loans from BIS reporting banks to Chinese banks have more than doubled to reach 1100 billion dollars and Chinese entities issued more than 360 billion dollars on the international capital markets.

This development of the international financing of China has immediate causes. A progressive relaxation of capital controls of capital inflows and outflows is underway. Banks and companies are probably using the new opportunities to tap cheaper financing than the one they can get from domestic sources whose credit activity remains somewhat under control. In addition, the big Chinese banks have quickly developed their international activities, in particular, their presence in the developed countries and the financing which they grant to emerging and developing countries.

Though still blurry, the picture that emerges from these data is different from the one of the previous decade, when China did not ‘inhale’ short term volatile capital flows.

Figure 1 below illustrates the rise of foreign assets and liabilities of China excluding FDI and foreign exchange reserves since 2009 according to the statistics of the balance of payments of the IMF. The growth in nominal terms has been spectacular. The liabilities rose from 0.8 to 2 trillion dollars whereas the assets increased from 1 to 1.7 trillion dollars.

BIS data cover different concepts. They exclusively list the claims and the debts of the banks of the member countries of the BIS which communicate to the latter their banking statistics (the so called “reporting banks” of “reporting countries”). Though a member of the BIS, China is not a reporting country.

They show (see Figure 2 below) an even more spectacular dynamic of the insertion of China in the international financial channels. In addition, the gap between assets and liabilities is even more pronounced than in the IMF balance of payments statistics. Chinese liabilities towards reporting countries rose more than 7 times, from 0.15 trillion dollars in the middle 2009 to 1.1 trillion dollars in the middle of 2014. During the same period, the claims of China on BIS reporting countries’ banks more than doubled.

The difference between the claims of China towards the rest of the world, computed by the IMF, and those towards developed countries computed by the BIS might lead to think that the Chinese banks recycle part of the resources they source in OECD countries to developing countries who do not declare their financial statistics to the BIS.

With their currency depreciating vis-à-vis the US dollar and reduced commodity prices, these countries are becoming more vulnerable.

What remains unknown is the share of Chinese banks’ external assets and liabilities that are denominated in RMB on whom they would have no foreign exchange risk and which could be re-financed by the Chinese central bank, the PBC, if necessary. It is likely that this share is still trivial but we better understand one of the issues at stake when it comes to the internationalization of the Chinese currency. In other words, China would rather inhale the smoke of its home made tobacco than that of international providers, namely US produced greenbacks.

For their part, the Chinese foreign exchange reserves should see their value stabilizing or even falling because of the mechanical effects of the interest rates in the United States (not to mention RMB/USD exchange rate) whereas trade surplus decreases and the slowing down of growth and domestic policies make the country less attractive for foreign investors.

The current level of the reserves assets (3.9 trillion dollars or so) shields China from an international payments crisis, still for a very long time. Even though this level is so high that a massive mobilization of these reserves would have worldwide systemic consequences, it is likely that the Chinese government would come to the rescue of its main banks should the latter be weakened by defaults on their foreign currencies loans to emerging and developing countries. Nevertheless, this implicit or, in the case of export credit, explicit guarantee will not shield international lenders from isolated defaults from Chinese counterparties that are not guaranteed by the Government.

|

Figure 1 : Chinese foreign assets and liabilities excluding FDI and foreign echange reserves since 2009 (billions of USD)

|

|

|

Source : IMF.

Figure 2 : Financial relations between China and BIS reporting banks  Source : BIS. |

< Back