The "new silk roads": an evaluation essay

(4/4): Obstacles on the road

China's international expansion follows multiple paths: trade, investment, finance and currency, to focus on the economy. In doing so, it pursues different objectives: security of supply, extension of its control over the China Sea and the nearby Pacific, access to new markets, maintenance of substantial trade surpluses to finance its global strategy, and, most importantly, access to the West's most advanced technologies to accelerate its own technological change. The new roads project appears to be the way to provide a flexible framework for China's overall strategy, integrating all these aspects. However, we can question its feasibility. Was the announcement of the project premature and/or out of proportion with the real means of today's China? Premature because it causes multiple reactions of mistrust [1]. Out of proportion, the term pharaonic is often used by commentators. Some estimate that the value of China's long-term commitments is between $4 trillion and $7 trillion [2]. China is certainly a very impressive country, but it is still a developing country.

Belt and Road Initiative (BRI) and the debt trap in developing countries

Many countries no longer support the controls exercised by international bodies, such as the World Bank and the IMF, which, in exchange for their financial assistance, impose their conditions for the use of funds and, for countries in default of payment, painful austerity programs. A way out of these controls appears for some to use Chinese loans. However, these loans do not, in most cases, fall into the category of concessional loans in the context of official development assistance. The conditions for granting these loans are not transparent: their exact amount, interest rates and conditions are unclear. This leads to an average underestimation of 15% of the debt amount of the countries involved and therefore to an underestimation of the associated risks [3]. An other problem is related to the place of Chinese companies and workers in making these investments. Finally, these projects do not always correspond to the priority needs of these countries and may turn out to be projects with high media visibility and low economic interest.

And finally, when the country is unable to service debt, it is constrained to hand over infrastructure management to a Chinese company. However, this is not enough to solve the balance of payments problems facing these countries. It is still necessary to call on international organizations, which then ask to know the financing conditions and the reality of the facts, which puts the governments in question in difficulty. The most worrying example is the one related to Pakistan's debt.

The Pakistan Corridor (CPEC) [4], the most ambitious component of the BRI project, includes the improvement of thousands of kilometers of roads, the construction of power plants and about ten Special Economic Zones. While in 2016, the IMF congratulated the government on its management, two years later the Pakistani economy was in crisis. Chinese credit disbursements account for 40% of the increase in public external debt between 2013 and 2017, while the surge in Chinese imports has widened the deficit. Confronted to the IMF, which makes its intervention conditional on austerity measures and transparency on the terms of Chinese loans, the Pakistani government turned to Saudi Arabia and China, which could require "mortgage taking" as it has done in Sri Lanka.

In the late 2000s, Eximbank financed the Sri Lankan port of Hambantota, town where the President was from. Being unable to meet repayment deadlines, the Sri Lankan government transferred its management to a joint venture company 80% owned by China Merchant for a period of 99 years. Since the signing of this long-term lease, several countries have expressed reluctance towards BRI projects. China's response to Sri Lanka's difficulties triggered a wave of mistrust spreading to Asia.

In Myanmar, China has submitted a project worth more than $10 billion to build a port the size of Manila, a 1600-hectare industrial zone and a new city. After the Hambantota case, this project was discussed and a commission suggested that the project be lowered to $1.3 billion. It is also a downward revision of Chinese projects that the new Malaysian government elected in 2018 is considering. Questioning the opportunity and cost of Chinese projects (East-West and North-South high-speed train lines, pipe and gas pipeline), Mahatir called for a review of the "unequal treaties" signed with China.

Among the many projects identified by the BRI, some are being considered in hazardous areas or economically risky countries. A Global Development Centre analysis identified 23 vulnerable countries, some of which are already in serious difficulty. These problems end up endangering Chinese development banks that have particularly high exposure to these risks [5].

If the countries receiving Chinese funds become cautious, China itself is concerned because, as we will see later, it does not have unlimited funds to address these risks.

Declining investment in the West

Chinese investments in the West are spectacular, but they are still several times smaller than those of the major Western companies. For instance, in the case of airports, Casil Europe (China Airport Synergie Investment Limited), a French company created and owned by Shandong Hi-speed Group and Friedmann Pacific AM [6], acquires 49.9% of the capital of Toulouse airport. Meanwhile, in early 2018, Vinci, by acquiring 12 Airports Worldwide airports through its subsidiary VINCI Airports, develops, finances, builds and operates 46 airports worldwide on a daily basis. At the end of 2018 Vinci Airports acquired a majority stake in Gatwick Airport (LGW), Great Britain's second largest airport (45.7 million passengers in 2018).

The expansion of Chinese private investment in the West declined sharply in 2017 and 2018. On the one hand, some Chinese companies, which have made acquisitions in all directions at the price of high debt, have been violently called to order by the Chinese government [7], and on the other hand, there has been a dramatic drop in Chinese FDI to the United States [8], partly due to the trade dispute between China and the United States and the increased scrutiny by American regulatory bodies of these transactions.

Faced with major financing shortages, the Wanda, HNA or Anbang groups are desperately looking for cash. These private groups close to the government have the disadvantage of having invested in sectors that are no longer considered a priority by the government. Wanda has invested in tourism, hotels, sports (Atletico Madrid), cinema, among others. HNA is active in real estate, tourism and finance (majority shareholder of Deutsche Bank). Since 2015, HNA has operated almost like an investment fund: the group has invested 40 billion dollars abroad, raising a total debt of nearly 100 billion dollars for 178 billion assets, according to the group. Finally, Anbang from the insurance sector diversified into real estate, hotels, banking and financial services. The fall of Anbang's emblematic boss in May 2018 was brutal: Wu Xiaohui was sentenced to 18 years in prison for fraud and embezzlement. The company was placed under State supervision for one year.

To sell these companies, the Chinese government has the absolute weapon at its disposal: it can at any time order the major Chinese state-owned banks to stop providing them with credit.

This policy is combined with the growing distrust of Westerners towards Chinese investments in so-called strategic sectors, particularly in the United States [9].Thus during the first half of 2018 the CFIUS (Committee on Foreign Investment in the US) blocked six Chinese investment projects. The most recent was the attempted acquisition for $9.9 billion of 45% of the capital of a polymer manufacturing company, Akron Polymer Systems. Some companies are targeted and should be excluded from public tenders for telecommunications systems and in particular for investments in 5G. This concerns in particular Huawei and ZTE... This questioning also reaches Europe, which is preparing to set up procedures for verifying investments in so-called strategic sectors.

La question du dollar et de l’internationalisation du RMB

China's expansion is taking place in a world dominated by the dollar, the only truly universal currency. This means that trade, investment and loans involving Chinese actors are mainly in dollars. According to estimates based on international transactions through the SWIFT system (see RMB Tracker January 2018), more than 80% of commercial transactions whose beneficiary is located in China or Hong Kong are in dollars. However, China does not have unlimited reserves in dollars, which can be a major constraint for the implementation of these BRI projects.

China has already lost $1 trillion in reserves in one year as a result of massive capital outflows in 2016, reducing its stock of official reserves to $3 trillion, which, according to some authors, would be the amount considered necessary to preserve China's financial independence in the event of international tensions. In addition, as mentioned above, many ongoing projects appear unrealistic and financially fragile, putting Chinese banks at risk.

Aware of these risks, the Chinese government chose in 2017 to put a brutal brake on the movement, designating some projects as irrational or not compatible with China's overall strategy. As we have just seen, other BRI projects have been revised downwards, sometimes at the request of the beneficiaries themselves.

As an alternative for the future, China is seeking to join other partners such as the World Bank and the Asian Development Bank. But this raises at least two problems: on the one hand, China will have to comply with the disciplines of these organizations, which it has so far contested, and on the other hand, it will have to face hostility from the United States, which suspects it of using these organizations to carry out projects for its own benefit.

Finally, to reduce the financial constraints associated with the domination of the dollar, there is the internationalization of the RMB, which would make it possible to finance a large proportion of these projects by operating the banknote printing press as the United States does. The internationalization of the RMB is indeed an official objective of the Chinese government, which aims at emancipating itself from the protection of the dollar, and BRI is conceived as a way to accelerate this process. But there are many obstacles to this transformation of the Chinese currency. In particular, the obligation to fully liberalize China's capital account, supposedly by 2020. Such liberalisation would considerably limit state intervention in capital flows and the monetary policy of the central bank, which would have to prove its independence from a communist regime.

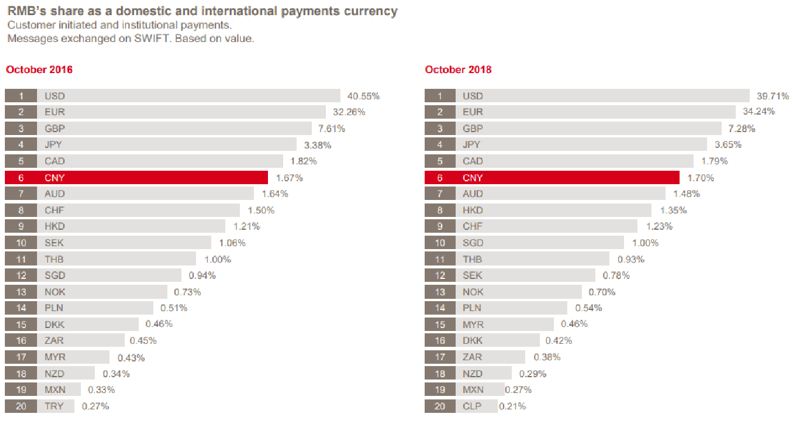

Despite numerous financial liberalization measures, the RMB's share in international transactions is 1.7%, it remains completely marginal and is not increasing. It is almost non-existent in central bank reserves and almost non-existent [10]. The same applies to the issuance of bonds: after reaching a maximum of $100 billion in 2015, its level has since fallen steadily to a minimum of $30 billion in 2018.

China, on the other hand, has a considerable level of domestic debt reaching 300% of GDP in 2018. Finally, the decline in current account surpluses reduces China's room for adjustment. All this is hardly beneficial to the internationalization of the Chinese currency.

Chinese projects appear to be out of standard, whether in terms of the amounts mentioned, the implementation timescales or the scale at the global level. And again, China's geopolitical, military, ideological and technological ambitions have hardly been mentioned here. The strong reaffirmation of the CCP's total pre-eminence over Chinese society and the desire not to let anyone dictate its conduct, contradicts the idea of multilateralism, which involves negotiating and seeking compromises between different systems. However, the difficulties China has encountered in implementing its programme may lead it to accept more transparency and to join other multilateral institutions.

[1] The same is true at the strategic level with the expansion into the China Sea and the reaffirmed threat of China's desire for reunification by force if necessary.

[2] By way of comparison, the Marshall Plan for the reconstruction of Europe amounted to the equivalent of $178 billion in 2018, most of which was distributed as donations to purchase American equipment. Fifteen European countries benefited from this plan, while more than 80 countries are interested in the new roads.

[3] Carmen Reinhart. 2018. The Hidden Debt Bomb that the Chinese have funded in emerging Markets. Published by Project Syndicate.

[4] In November 2017, Pakistan decided to withdraw from the $14 billion Diamer-Bhasha dam project - a central element of the Chinese program in Pakistan - because Islamabad refused Chinese financial conditions. In the same month, Nepal abandoned a $2.5 billion dam project with the state-owned China Gezhouba Group because it had not been the subject of an open tender.

[5] These problems are in addition to other problems that precede the BRI project, such as Venezuela's debt project. China has lent $50 billion over the last ten years in exchange for oil deliveries. The largest loan was from the China Development Bank in 2010. It exceeded $20 billion, a loan whose terms are not known. If Venezuela were to default, the bank would be in default and the Chinese state should bear the cost. Other projects such as the trans-oceanic canal project signed in 2013 by Chinese billionaire Wang Jing for $50 billion have been abandoned.

[6] Hong Kong investor officially supporting China's "Silk Roads" policy and has already taken control of Tirana International Airport.

[7] In August, limits were imposed on Chinese investments abroad that targeted activities developed by Wanda - real estate, hotels, leisure and sports -. The Chinese government was seeking to curb capital outflows that could destabilize the financial system. The administration also wanted to reduce the problems caused by "irrational or risky" investments by Chinese companies abroad.

[8] There was a 30% decline in investment in value terms in 2107 and a 90% drop in new investment announcements in 2018. Investments in Europe are more or less stable.

[9] See blog 3/4.

[10] However, with the exception of Russia, which, fearing the consequences of the conflict and the sanctions against the United States, has decided to halve its foreign exchange reserves held in dollars (-101 billion or 22% of total reserves) in favour of the Euro and the RMB (44 billion each) and the rest in favour of the Yen. The gold stock increased to 78 billion; the total amount of reserves then reached 460 billion dollars at the end of 2018.

Jean-Raphaël Chaponnière is an associate researcher at Asia Centre and the Asia21

< Back