U.S. Tariff Hike: Uneven Effects Across Sectors

The United States are the main destination of European Union (EU) exports (excluding the Single Market). As transatlantic trade tensions intensify, some European industries are particularly exposed to the risk of losing access to the U.S. market.

By Pierre Cotterlaz

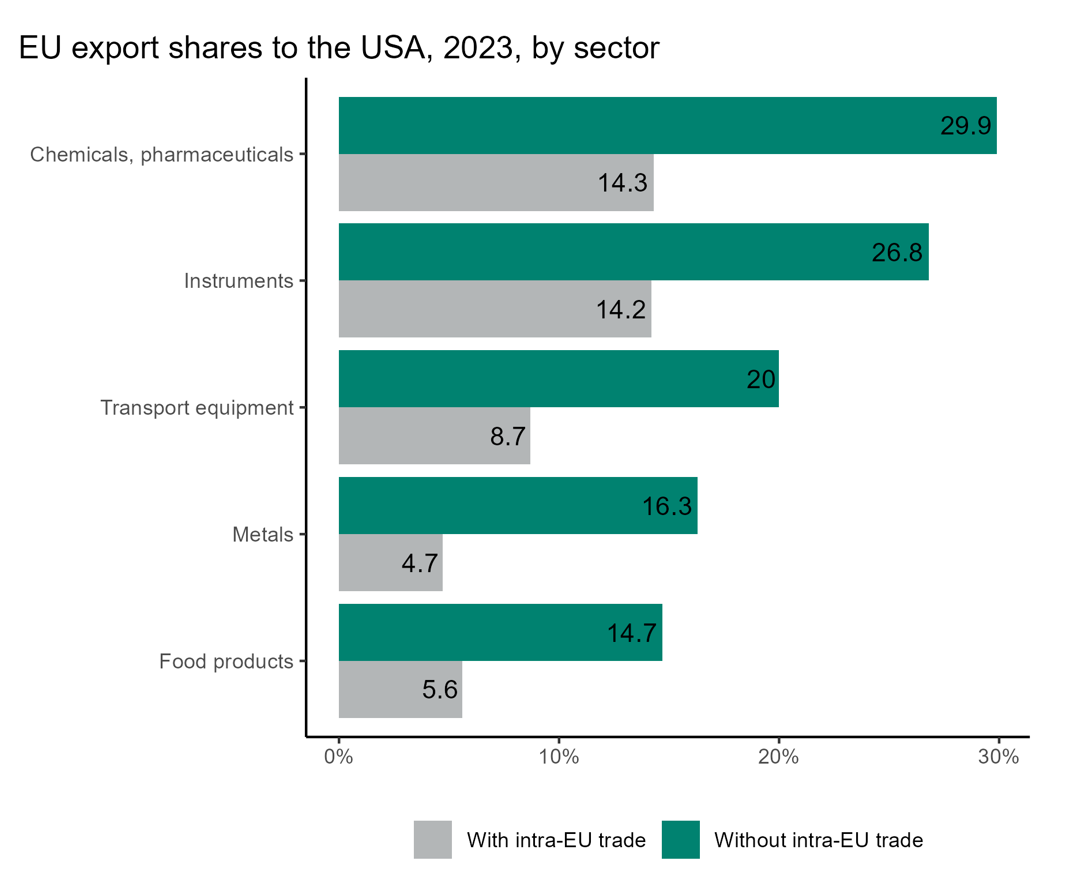

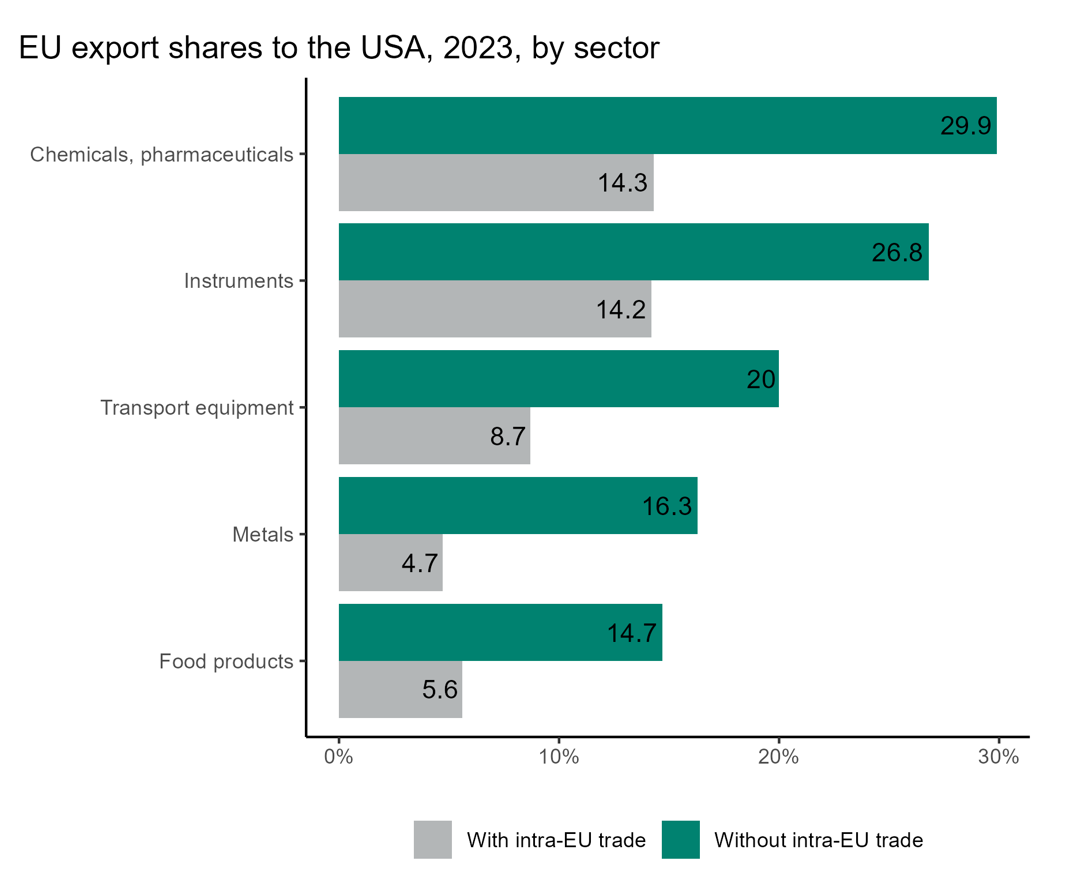

In 2023, the United States accounted for one-fifth of European exports (excluding intra-EU trade). They are an essential market for some sectors, especially pharmaceuticals and measuring instruments, which direct 30% and 27% of their extra-European sales to the U.S., respectively.

For other sectors targeted by the U.S. trade offensive, exposure remains significant but lower: 20% for transport equipment, 16% for metals, and 15% for food products. Taking the EU Single Market into account, the degree of exposure appears more moderate, but the U.S. still represent a substantial share: including intra-EU trade, 8% of European exports go to the United States.

Even with this adjustment, pharmaceutics and measuring instruments remain the most exposed sectors to the U.S. market and, therefore, the most vulnerable to an increase in tariffs under the Trump administration.

To find out more, see the CEPII EU-US trade dashboard.

Notes: The sectors correspond to the "section" level of the Harmonized System (HS) classification, which includes 22 sections. Among the five sectors considered here, four contain products frequently mentioned in U.S. tariff threats: steel and aluminum in "metals", alcoholic beverages in "food products", automobiles in "transport equipment", and pharmaceuticals in the "chemicals and pharmaceuticals" section. A fifth section, "instruments", ranks second among European exports to the United States in value.

It includes optical, photographic, and cinematographic instruments and devices, as well as measuring, control, and precision instruments, along with medical and surgical equipment.

Source: CEPII, EU-US trade dashboard.

Trade & Globalization | Competitiveness & Growth | Emerging Countries >

> LE Graphique / THE Chart

For other sectors targeted by the U.S. trade offensive, exposure remains significant but lower: 20% for transport equipment, 16% for metals, and 15% for food products. Taking the EU Single Market into account, the degree of exposure appears more moderate, but the U.S. still represent a substantial share: including intra-EU trade, 8% of European exports go to the United States.

Even with this adjustment, pharmaceutics and measuring instruments remain the most exposed sectors to the U.S. market and, therefore, the most vulnerable to an increase in tariffs under the Trump administration.

To find out more, see the CEPII EU-US trade dashboard.

Notes: The sectors correspond to the "section" level of the Harmonized System (HS) classification, which includes 22 sections. Among the five sectors considered here, four contain products frequently mentioned in U.S. tariff threats: steel and aluminum in "metals", alcoholic beverages in "food products", automobiles in "transport equipment", and pharmaceuticals in the "chemicals and pharmaceuticals" section. A fifth section, "instruments", ranks second among European exports to the United States in value.

It includes optical, photographic, and cinematographic instruments and devices, as well as measuring, control, and precision instruments, along with medical and surgical equipment.

Source: CEPII, EU-US trade dashboard.

< Back