Sovereign risk and asset market dynamics in the euro area

Returns in the euro zone stock-sovereign bond markets

As stocks potentially pay an infinite stream of uncertain dividends whereas bonds' pay a fixed number of pre-determined coupon income, returns vary reacting to the business cycle and the different shocks that affect an economy.

It is important that both investors and policy makers understand this evolution. From a finance perspective, the correlation between stock and bond returns implies the presence of risk and calls for diversification of investors' portfolios. From an economic perspective, knowing the effect of macroeconomic dynamics on asset prices and returns contributes to take informed policy decisions.

Additionally, in a currency union, the behavior of the correlation between bond and stock returns in the member countries reflects the degree of integration between the different members. In highly integrated economies, this relation should vary in the same way over time. This applied to the euro area until 2009.

Figure 1 shows that from 2010 to 2014 the difference between the periphery and core co-movements (dotted black line) reflects the growing divergence of stock-bond correlation within the euro area (Perego and Vermeulen, 2016) .

This behavior is consistent with a flight-to-quality on sovereign bond markets, from risky periphery bonds to safer core ones (figure 2, left panel), and, conversely, a stable high correlation among euro area stock markets (figure 2, right panel).

Understanding the transmission mechanism

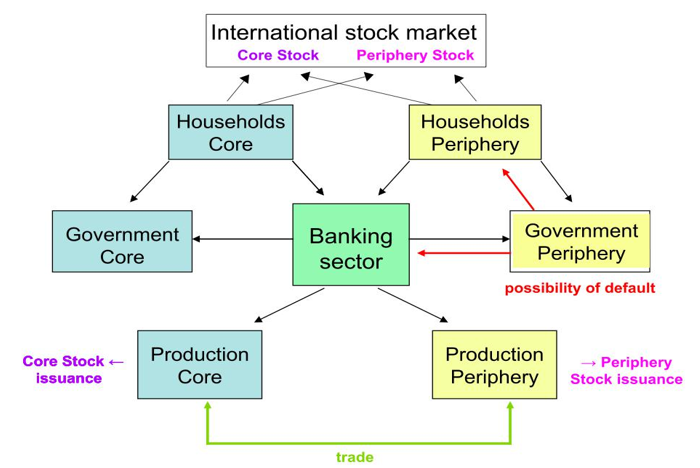

Perego (2018) explains the divergence in the core-periphery stock-bond co-movements during the years 2010-2014 by building a quantitative model able to study the impact of the sovereign debt crisis and the underlying propagation mechanisms to the euro area as a whole. The model is characterized by two blocks, core and periphery, each populated by firms, households and government. The two blocs are linked by an integrated banking sector (Enders et al., 2011), international financial markets and trade linkages (Coeurdacier et al., 2007) as shown in figure 3.

The sovereign shock is an increase in the probability of default whose process is estimated from the data following the approach of de Grauwe and Ji (2013) and then feeded to the model as in Corsetti et al. (2013). When sovereign default risk increases i) bond's interest rates increase; ii) and this, ceteris paribus, increases the stock of debt via the higher cost of servicing the debt, calling for an increase in taxation (or decrease in public spending) to stabilize the economy. This stabilization mechanism decreases households' demand, bringing to a reduction in investment and capital and depressing the value of equity in the periphery. At the same time, international investors (banks) substitute risky periphery bonds for risk-free core ones. This determines the so-called "flight-to-quality" in sovereign bond markets and explains the left panel of figure 2. As core and periphery banks are exposed to periphery debt, a sovereign risk shock impacts both core and periphery credit supply via higher credit spreads. Higher credit spreads translate into a lower value of capital, lower equity prices and returns in the core. Higher credit spreads also impact periphery firms and further reduce the value of capital and equity. The credit supply mechanism explains why core and periphery equity markets continued to co-move during the sovereign debt crisis despite displaying different returns' levels (figure 2, right panel).

Implications for policy makers

These results are of great interest for policymakers as they suggest that troubles in one of the euro area sovereign bond markets have an impact on both the financial and the real economy of the euro area as a whole. Understanding the transmission mechanism and, in particular, the role of banks in spreading shocks across the union calls for a coordinated resolution of eventual crisis and can help policymakers in designing more effective policies on different grounds, like banking regulation and monetary policy.

Bibliography

Appendix

Data source: Datastream

[1] Notes. Stock market series are total return indexes on non-financial firms; bond series are benchmark 10 year indexes of yields to redemption. Core countries are: Austria, Belgium, Finland, France, Germany and the Netherlands. Periphery countries include: Greece, Ireland, Italy, Portugal and Spain. The shaded areas highlight the period of the sovereign debt crisis.

[2] Notes. Stock market series are total return indexes on non-financial firms; bond series are DS benchmark 10 year indexes of yields to redemption expressed in percentage points. Core countries include: Austria, Belgium, Finland, France, Germany and the Netherlands. Periphery countries include: Greece, Ireland, Italy, Portugal and Spain.

< Back